Giveffect just added the ability to easily accept and track Bitcoin and other cryptocurrency donations through our new integration with The Giving Block.

The Giving Block (TGB) is the number one crypto donation solution and allows nonprofits to receive funds instantly. Nonprofits have the option to automatically convert the donation to dollars. Alternatively, nonprofits can opt to hold the cryptocurrency. The choice is yours! And you can always change your settings.

Let’s take a quick review of what cryptocurrency is and why it is likely important to your nonprofit.

What is Cryptocurrency?

Cryptocurrency uses cryptography (or a complex encoding, blockchain) to create a digital currency. Cryptocurrency transactions use a decentralized system to verify and maintain records rather than a centralized authority such as the US government. To put it simply, cryptocurrency is a digital asset that functions like currency.

In general, Cryptocurrency comes with benefits as well as challenges. Online currencies are often not regulated and can be difficult to manage. Because cryptocurrency is somewhat new, many nations’ laws are still catching up. Some nations have taken steps against crypto, while other nations have moved to support it.

Individual online currencies can have different rules or limitations placed on them by their creators. For example, there may be a total limit on the amount of currency in circulation. New digital coins may only release only on a specific schedule.

Why Should Nonprofits Pay Attention to Cryptocurrency?

Right now, less than 1 percent of nonprofits accept cryptocurrency donations, according to The Giving Block. But the most popular cryptocurrency, Bitcoin, currently (as of May 16, 2022) is at about $29,000 in value for one. That’s right, one bitcoin is the equivalent of $29,000 USD! That figure probably instantly grabs your attention and shows you just how much money that could be at play here for any nonprofit. Like any currency, the exact exchange rate can vary and fluctuate. And cryptocurrency tends to be volatile. For example, just within the six months prior to this article’s publish date, Bitcoin experienced a low value of $28,000 and a high of around $65,000.

Cryptocurrencies represent massive amounts of money and a quickly growing pool of investors. Additionally, curious laymen are dipping their toes in the water. Overall, an estimated 16 percent of Americans say they have personally invested or traded in cryptocurrency at some point, according to a Pew Research study. That percentage equates to about 50 million people. Of that, young people, 18-29 years, are investing in it even more, with 31 percent saying they have invested or traded crypto.

Broadly, crypto investing is fairly well-represented across classes and incomes. For instance, 17 percent of high income, 17 percent of middle income, and 15 percent of low income say they have invested in crypto. And even more importantly, it’s growing, almost doubling from an estimated 15 percent in 2019, according to Statista.

Young people, 18-29 years are using cryptocurrencies even more, with 31% saying they have invested or traded it.

Pew Research study

How Can Nonprofits Benefit from Cryptocurrency Donations?

In today’s rapidly evolving landscape, nonprofits should continue to identify all possible funding streams so as to maximize their potential donor base. This new influx of wealth in the world, offers great potential and the opportunity to receive contributions from new supporters as well as from current donors.

Accepting a crypto donation through a processor such as The Giving Block will instantly convert crypto donations into U.S. dollars, leaving virtually no risk to your organization. Therefore, you receive the value of the cryptocurrency the moment it is donated.

How Can Nonprofits Accept Cryptocurrency Donations?

First, discuss with your financial team about any potential conflicts or nonprofit-specific rules your team must abide by. Then, simply set up a system that can accept crypto payments.

For example, a system like The Giving Block allows nonprofits to fundraise and accept cryptocurrencies in an automated system and provides resources to learn more about it.

For Giveffect users, accepting cryptocurrency donations is simple. Once you have your TGB subscription and ID number, follow the steps by step guide found in the Help Center to activate and enable it. The customer success team is also available to help.

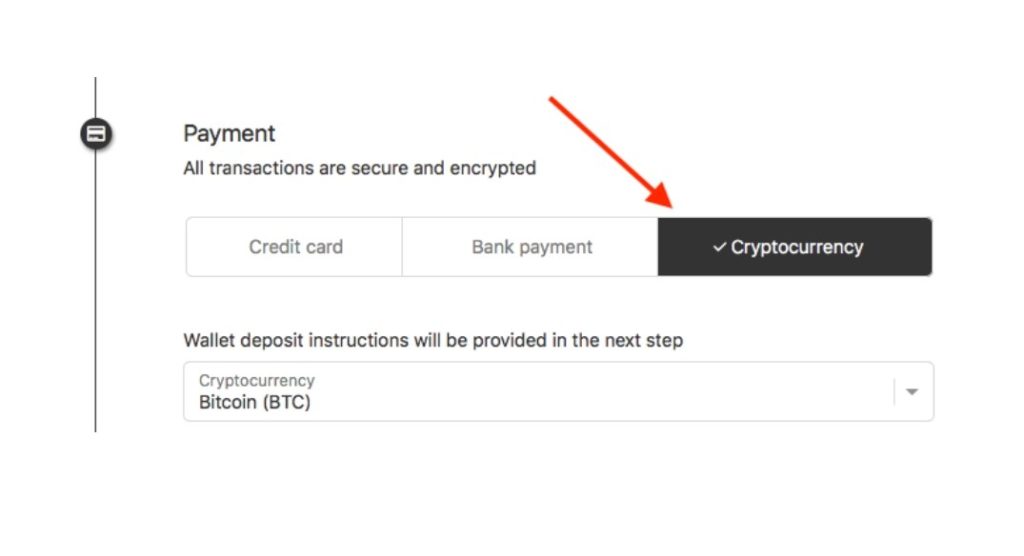

Your Giveffect payment forms now include Cryptocurrency as a payment method. Set up online giving campaigns just as you typically do, but now your donors have the option to contribute to your nonprofit with a wide range of cryptocurrencies. This is what the checkout portion of your online donation checkout forms looks like to your donor:

This integration will allow your organization to accept cryptocurrencies from your Giveffect payment forms, record the gift details in your CRM, and even issue tax receipts.

Are you interested in learning more about the Giveffect and The Giving Block integration? Schedule your demo today! Already a Giveffect customer and interested in accepting cryptocurrency donations? Reach out to your Customer Success representative or email support@giveffect.com.